‘Real Estate’ in Spain Will Live up to Its Name and Hold Firm During the COVID-19 Crisis, Predicts Agent Adam Neale

Once life returns to normal, the country will remain a great place to live and spend time for those lucky enough to own property here

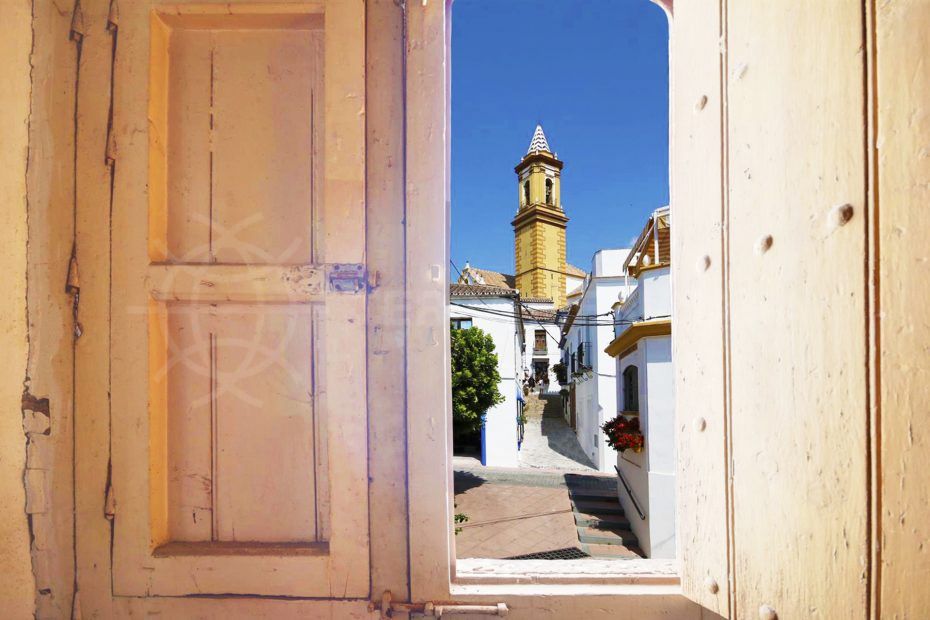

PHOTO: THE SPANISH ESTATE

Source: Adam Neale (Columnist), The Olive Press

THE short-term market prospects for Spanish residential real estate look set for an extended period of uncertainty while Spain and our neighbours in Europe focus on containing the coronavirus pandemic.

There are good reasons, however, to be confident demand for property on the Costa del Sol will rebound quickly and the market will make a solid recovery.

There has been an immediate stagnation in property sales, as notaries around the country have been advised to postpone the signature of all deeds while the state of emergency is in force, except for limited ‘urgent’ cases.

So although we continue to receive enquiries from clients who want to arrange property viewings once the lockdown is over, we can expect no transactional movement for the foreseeable future.

In contrast to the financial meltdown of 2008, this is very different. During that crisis, banks, businesses and even individuals suffered consequences (provoked, some would argue, by the ill-informed choices of greedy financial institutions).

This time, most nations and especially those in the EU acknowledge the epidemic as a natural disaster that affects everyone. In principle, at least, governments are committed to ensuring that societies and economies do not fail, whatever it takes.

Moreover, during the 2008 crisis Spain, and particularly the Costa del Sol, suffered the bursting of a bubble that had been forming for several years, with record levels of construction and credit in the form of highly leveraged mortgages.

This is certainly not the case now. The market is not vulnerable as it was in 2008, new construction represents a much smaller share of the overall property market and banks have been cautious with lending.

For these reasons, in the medium term, the demand for residential property in southern Spain, and coastal areas like Estepona, Marbella, Benahavís and Sotogrande in particular, is not at risk from drastic market correction.

Of course there will be some who are forced to sell for personal reasons but in general, it’s likely that things will pick up again, albeit slowly, when normality returns.

Compared to shares and bonds, which have posted record losses in recent weeks as the coronavirus epidemic has evolved, property is a tangible asset that can be used or can provide a return, even in a worst-case scenario.

Homes can be rented out, generating income for the present and accruing value for the future. Investing in property, whether it’s a main residence, second home or part of a portfolio, buys you something that exists and, irrespective of market rises or falls, is a solid shelter for savings, especially over time. There’s a good reason it’s called ‘real estate’.

In the longer term, as COVID-19 reminds us, life can be all too short. We moved to Spain two decades ago, to raise our family, build a business and make the most of the wonderful place on the Costa del Sol we call home.

Once life returns to normal, the country will remain a great place to live and spend time for those lucky enough to own property here.

USA 917-679-1211

USA 917-679-1211

© Jackson Lieblein, LLC 2015.

© Jackson Lieblein, LLC 2015.