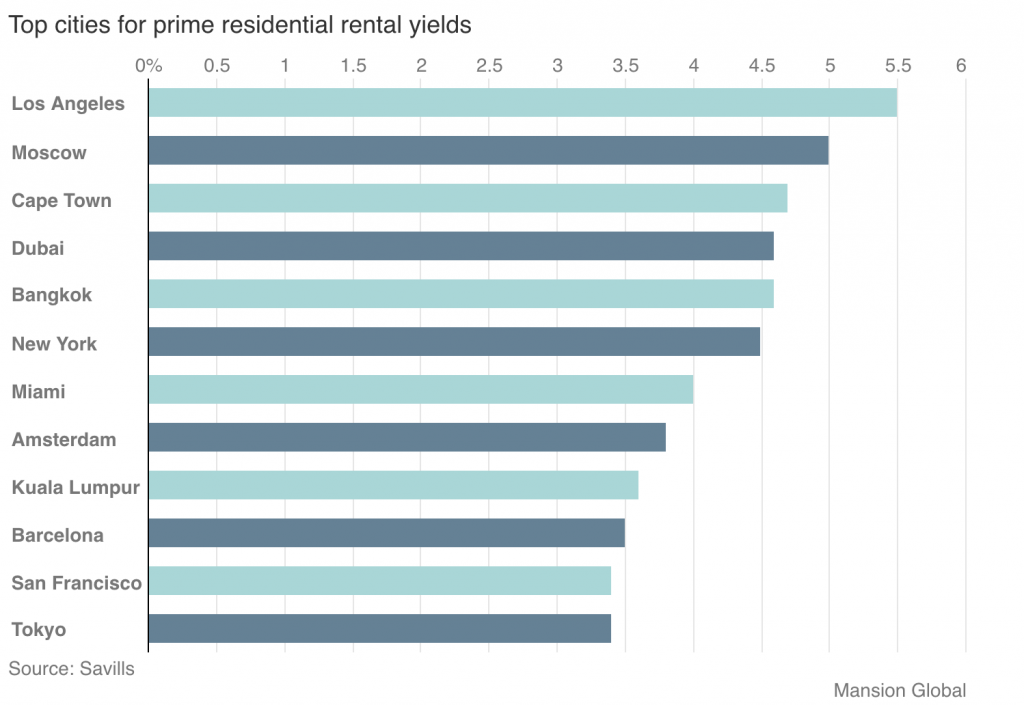

Around the World, Luxury Los Angeles Rentals Offer Best Investment Returns

In 2019, the California city was No. 1 for landlords, followed by Moscow and Cape Town, South Africa

Los Angeles-based luxury landlords had a banner year in 2019, making significant returns on their investments, according to a report Thursday from Savills.

Typical yields for prime rentals in La La Land last year were 5.5%, besting the 25 other major global cities tracked by the London-based estate agency in its Prime Residential Rental Index.

A rental yield is the percentage of the cost of the property a landlord can make from one year’s rent.

The Southern California city also saw the highest increase in rents, with a 6.1% increase in 2019 compared to 2018.

Yields were pushed up due to more younger people shifting to renting rather than buying, the report said.

Moscow followed closely after, with prime rental yields of 5% in 2019. In the Russian capital, returns were driven by high levels of activity from corporate tenants, according to Savills.

Cape Town, South Africa, ranked third, with yields of 4.7%.

Across all the cities Savills tracked, the average rental yield increased 3.2% in 2019, the report said. Actual rents, meanwhile, increase by an average of 1.2% over the year.

“In the first half of 2019, average annual rental values in the index outperformed capital values for this first time since 2008, and this continued in the second half of the year,” Sophie Chick, head of Savills world research, said in the report.

“As prime residential capital value growth is forecast to remain at modest levels, the search for income will be increasingly important for global investors, and the prime residential sector in key global cities can provide appealing yield potential,” she said.

Source: Liz Lucking, Mansion Global

USA 917-679-1211

USA 917-679-1211

© Jackson Lieblein, LLC 2015.

© Jackson Lieblein, LLC 2015.